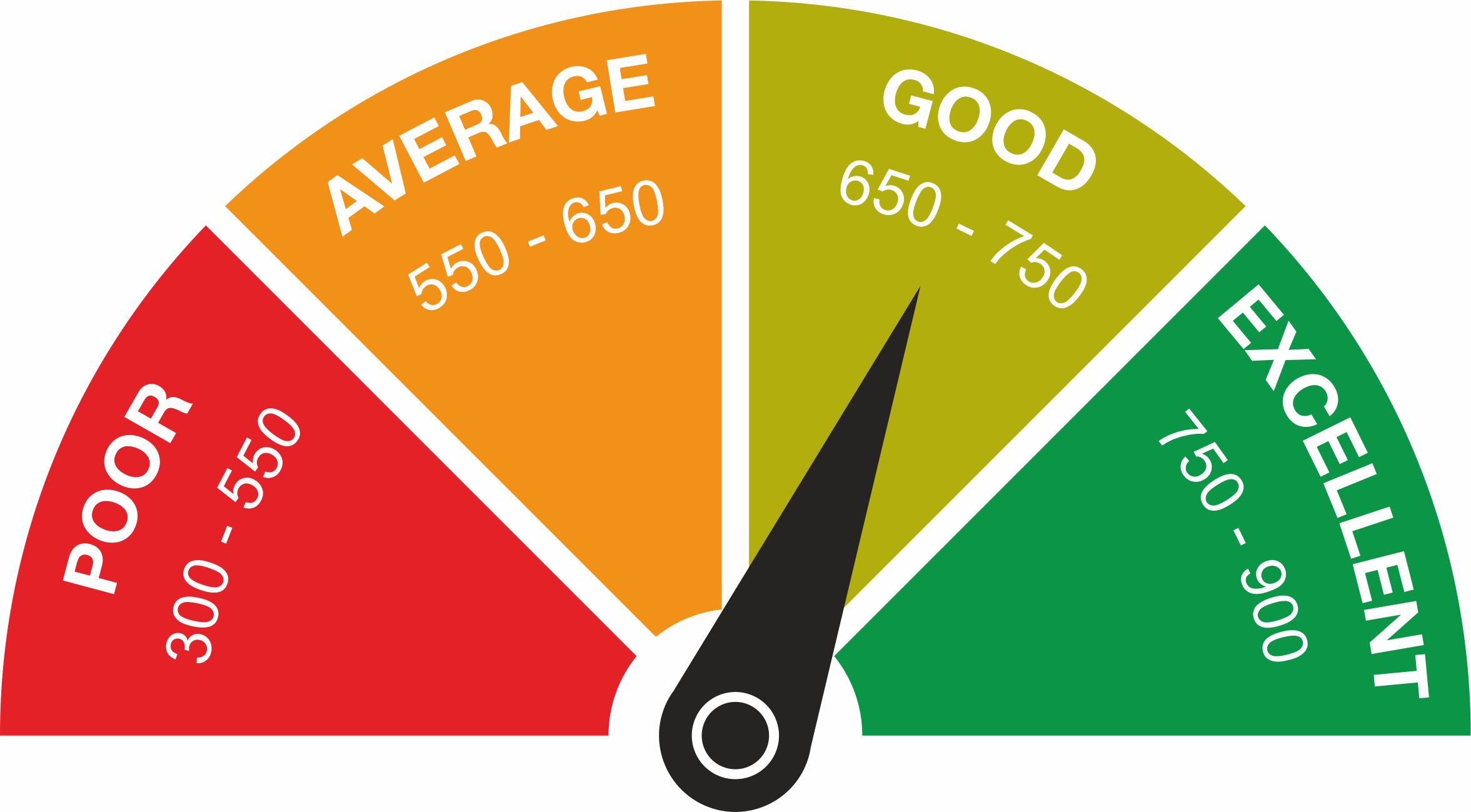

The CIBIL score is an important aspect of your financial health and is used by lenders and financial institutions to assess your creditworthiness. It ranges from 300 to 900; the higher the score, the better your creditworthiness is perceived by lenders. You need to regularly check and monitor your CIBIL score to ensure your ability to access loans and credit cards in the future. Even though you may be financially responsible, a lack of awareness about your CIBIL score can lead to actions such as applying for multiple credit cards simultaneously, which can harm your credit score and reduce your borrowing eligibility.

By performing CIBIL score check regularly by using PAN Card by utilizing online services like Bajaj Finserv Credit Pass, you can make the necessary changes to improve your creditworthiness and increase your eligibility for loans and credit cards in the future. So, it is also very important to understand how to check CIBIL score with PAN card, as the PAN number is necessary to access your credit information.

Listed below are the reasons to check your CIBIL score & credit report daily

Track and build your score

As regular monitoring and healthy habits are crucial for maintaining good physical health, responsible behavior with credit is important for maintaining a healthy credit score. Regularly performing CIBIL score check can increase your understanding of your credit standing and allow you to make informed decisions to improve or maintain your score. It also helps you to understand how to check CIBIL score with PAN card. Unfortunately, a lack of awareness can sometimes lead to actions that can harm your credit score, such as applying for multiple credit cards at once. Consistent monitoring of your CIBIL score and smart credit habits can help you track your progress.

Keep yourself prepared for financial milestones

It’s important to remember that improving your credit score takes time and patience, typically several months. It may be too late to make significant improvements if you wait until you need to borrow money to check your credit score and find it low. This can have serious consequences, especially in a financial emergency. A low credit score can also negatively impact your plans, such as buying a home, which often requires a home loan for most people. Regularly doing a CIBIL score check activity online on Bajaj Finserv Credit Pass allows you to maintain good credit health.

Early detection of fraud

Regular CIBIL score check activity online is even more important in light of recent reports of identity theft. Fraudsters may try to access credit using your personal information, such as your PAN. By consistently doing CIBIL score check activity, especially the section that lists all your active credit accounts, you can quickly identify any suspicious activity and take action to resolve the issue with the credit bureau. The dispute resolution process may differ among bureaus.

Monitor for inaccuracies

Regularly monitoring your CIBIL score check and credit report is crucial to managing your credit health. Credit bureaus gather and compile information about your credit history and generate reports based on the data provided by banks, non-banking financial companies and credit card issuers. However, errors can sometimes creep into your credit report even with proper procedures. These errors, such as incorrect information about your accounts or even someone else’s loan accounts appearing in yours, can harm your credit score and decrease your ability to borrow. So, ensuring that you understand how to check CIBIL score with PAN card is very important.

Assist you in tracking your credit utilization ratio

Maintaining a strong credit score requires more than just paying bills and EMIs on time. Another factor that plays a role is the Credit Utilization Ratio, which reflects how much credit you use with your available credit. If you regularly max out your credit cards, it can harm your score, indicating a dependence on credit. Keeping your CUR below 50% is best to maintain a healthy credit score. Regularly doing CIBIL score check on Bajaj Finserv Credit Pass services by Bajaj Finserv can help you identify any issues with your CUR. You can lower it by using less credit, requesting a higher credit limit from your card issuer, or obtaining a new credit card to increase your overall credit limit.

Final Thoughts

Your credit report is the key to understanding the factors contributing to your credit score. It provides a comprehensive overview of all the information determining your credit score. By carefully doing CIBIL score check or reviewing your credit report, you can understand each parameter that affects your score, such as payment history, credit utilization, length of credit history, types of credit accounts, and outstanding debts. By focusing on these parameters, you can identify areas that need improvement and take steps to enhance your credit score. If your credit utilization is high, you can reduce your debt and improve your payment history, positively impacting your credit score.